Analyzing the Liquidity of Cryptocurrencies on Bitsquare.io

Analyzing the Liquidity of Cryptocurrencies on Bitsquare.io

Understanding Liquidity in the Cryptocurrency Market

Cryptocurrencies have gained significant popularity in recent years, with numerous platforms facilitating their trading. One such platform that stands out is Bitsquare.io. However, before you start trading, it is essential to understand the concept of liquidity and how it plays a crucial role in your cryptocurrency trading journey.

What is liquidity in cryptocurrency trading?

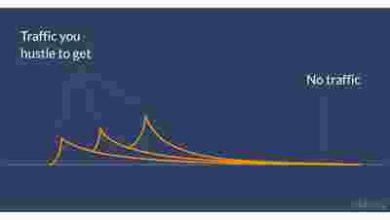

Liquidity refers to the ease with which a cryptocurrency can be bought or sold without significantly impacting its price. In simple terms, it measures how quickly and efficiently you can convert your digital assets into cash or other cryptocurrencies.

Why is liquidity important for cryptocurrency traders?

Liquidity is critical for traders as it affects various aspects of their trading experience. A liquid market ensures that traders can enter or exit positions at their preferred price without causing significant price fluctuations. It also enables traders to execute larger trades without drastically impacting the market prices.

How can you analyze the liquidity of cryptocurrencies on Bitsquare.io?

Bitsquare.io is known for its decentralized and peer-to-peer cryptocurrency exchange network. While analyzing liquidity on Bitsquare.io, you can consider the following factors:

1. Trading Volume: The higher the trading volume of a cryptocurrency on Bitsquare.io, the more liquid it is. Look for currencies with substantial trading volumes to ensure smoother trading experiences.

2. Order Book Depth: Assess the depth of the order book for a particular cryptocurrency on the platform. A deeper order book indicates higher liquidity, as it implies there are more buyers and sellers for that currency.

3. Spread: Analyze the difference between the highest bid price and the lowest ask price on Bitsquare.io. A narrow spread indicates higher liquidity and a smaller price discrepancy.

Frequently Asked Questions about Analyzing Cryptocurrency Liquidity on Bitsquare.io

Q: Can I rely solely on trading volume to determine liquidity on Bitsquare.io?

A: While trading volume is a crucial factor, it should not be the sole determinant of liquidity. Considering factors like order book depth and spread can provide a more comprehensive picture of liquidity on the platform.

Q: Are highly liquid cryptocurrencies always the best choice for trading?

A: While highly liquid cryptocurrencies offer advantages like quick order execution, it is important to consider other factors such as market volatility and individual trading goals before choosing the best cryptocurrency to trade.

Q: Does liquidity vary for different cryptocurrencies on Bitsquare.io?

A: Yes, liquidity can vary significantly between different cryptocurrencies on Bitsquare.io. Some popular cryptocurrencies may have higher liquidity compared to less-known or newer cryptocurrencies.

Conclusion

Analyzing the liquidity of cryptocurrencies on Bitsquare.io is crucial for successful and efficient trading. By considering factors such as trading volume, order book depth, and spread, you can make informed trading decisions and maximize your chances of success. Remember, while liquidity is important, it is just one factor to consider in your overall trading strategy.

Do you have any other questions about liquidity on Bitsquare.io or cryptocurrency trading in general? Feel free to reach out to us, and we’ll be happy to help!